Estimating payroll taxes is a complicated and detailed process as there are many federal and state taxes that may apply to an employee’s paycheck. Also, some taxes are paid by the employee, some by the employer, and others are shared by both.

Payroll taxes usually consist of federal and state income taxes, Medicare and social security, disability insurance, unemployment, and worker’s compensation taxes.

The company’s employer withholds these taxes from the employee’s paycheck and submits them to the government.

Steps to estimate your taxable amount

Contents

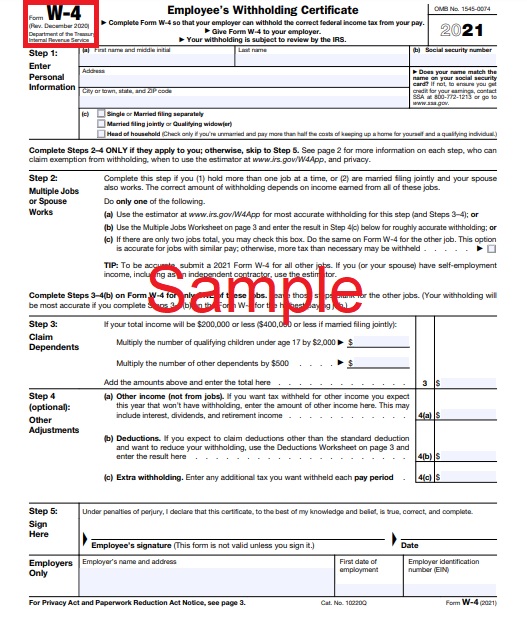

Get your Employee W-4 Form

You need your employee’s W-4 Form to gather important information for calculating withholding tax. You can download it on the IRS website, but here is a sample for you to look at for your convenience.

Calculate the gross pay

Gross pay is the total payable amount to the employee before any withholdings and deductions.

- To calculate the gross pay, divide the employee annual pay by the number of annual pay periods.

- For the hourly employee, multiply the hourly rate with the total worked hours in a pay period.

Let’s consider the annual salary is $30,000 and yearly pay periods are 12. The gross pay for one pay period will be $2500 ($30,000 divided by 12). To get the gross pay, also include any overtime pay.

Calculating overtime

For hourly employees, overtime is entitled if they work more than 40 hours per week, whereas salaried employees are exempted from overtime based on the pay level. Lower paid employees with salaries less than or equal to $455/week can receive overtime even if they are classified as exempt.

Suppose David works 45 hours a week and is entitled to 5 hours of overtime at 1.5 times of hourly rate. So, if the hourly rate is $12, he will receive overtime at $18, and the total overtime will be $90. You will add this overtime to the regular hourly pay of $480 (40 hours x $12). The total gross pay for a pay period will be $570.

Adjust the gross pay

Before calculating FICA and income tax withholding, there is a need to remove certain types of payments made to employees.

For example, the 401k plan isn’t included in the calculation for Federal income tax or social security tax.

Calculate Federal Income Tax Withholding

Calculate federal income tax withholding using the adjusted gross pay, W-4 Form, and a copy of tax tables from the IRS Publication 15.

Make sure that you are using the tax table for the correct year.

Calculate Social Security and Medicare Deductions

While calculating the net paycheck, you must withhold social security and Medicare deductions (FICA taxes) from the paycheck. FICA taxes have flat rates that apply to all the employees and employers.

From the employee’s paycheck, social security tax is assessed at 6.2% and Medicare at 1.45% of gross wage, making 7.65% withholding.

Social security tax withholding applies only on the base income under $127,200. No additional taxes are applied on earnings exceeding this amount. However, for employees whose income reaches $200,000 per year, additional tax is applied on gross pay at the rate of 0.9%.

Take out State Income Tax Deductions and other deductions

States also impose income taxes on employees’ salaries. Therefore, you have to do some research to find out the total deductions applicable to your gross pay.

At last, you might have to take out other possible deductions that include:

- Health plan coverage deductions

- 401k or retirement plan deductions

- Internal company fund or charitable donations deductions

Do the math of all the above

To estimate the total amount that should be deducted from the paycheck, add up all the values calculated for FICA taxes, income taxes, and other deductions and subtract it from the gross pay. The amount left will be your net pay.

Now divide your total deductions and net pay with a total number of pay periods to determine the amount per paycheck.

You can also use online paycheck calculators to determine the net pay that you can take home.