Every savings bond is issued by the Department of Treasure, for that reason, they are considered one of the safest investments because the credit of the U.S. government backs them; this service also helps them with borrowing needs.

This department is the only one authorized to sell saving bonds, and they do it through banks and credit unions. In other words, you can be sure that you will receive the money when you cash your bond.

If you have one, you cannot sell it or give it away because since your name is written in the bond, generally, you are the only authorized person to cash it. However, in this article, we will show you some exceptions to this rule.

Cashing a savings bond

Contents

Commonly, if you want to cash a savings bond, the bank representatives will ask you for identification documents; this may include U.S passport, employee ID, state ID card, trade license, green card, and even your driver’s license.

But if you think that a savings bond is the only thing that can be cashed in someone else’s name, then you should know that personal checks are also possible. For example, you can go to the bank and cash your spouse’s personal check, but you need the endorsement first. On top of knowing this, it is important to know where can I cash a personal check.

On the other hand, there are some exemptions to the savings bond situation.

Sometimes a different person can cash these types of bonds on behalf of someone else, but the bank representatives will ask for a document of authorization; the type document will depend on the role or relationship with the owner.

Here are some specific situations and its requirements:

Parents or guardians

As we know, children underage are legally incapable of signing any documents. So, if they own a savings bond, the parents or guardian can cash it.

If this is your case you will have to present:

- The birth certificate.

- The guardian’s authority certificate.

- Your identification document (in most cases, it is the driver’s license).

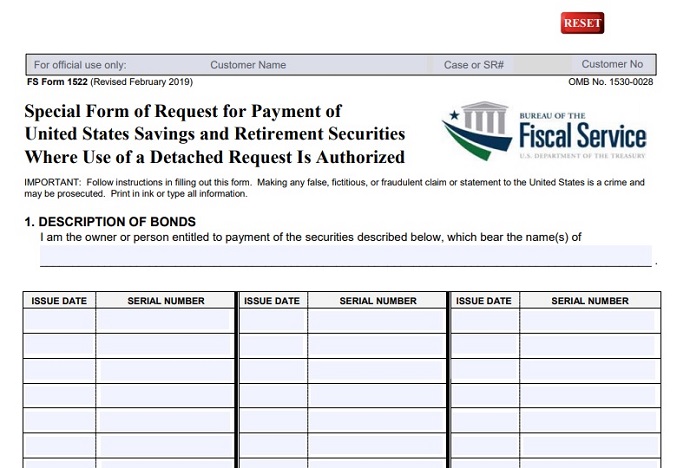

- FS Form 1522. The U.S Department of Treasure issues this form for cashing bonds procedures. In it, you will have to provide information about yourself, your savings bonds identification, your bank account, the office where you are going to cash it, and your signature.

In some cases, if the certifying officer considers that the child is capable of understands this type of transaction, he or she can sign the form.

Here is the link where you can find the form: www.treasurydirect.gov/forms/sav1522.pdf.

By the time you sign, you have to endorse the bond and certify your authorization. For example, you can write something like, “I certify that I am the guardian of Thomas Miller, age 5, who is unable to sign and make this request legally. Sarah Brown, on behalf of Thomas Miller.”

Beneficiary

If a person owns a savings bond and suddenly dies, another person can cash it, but only if it was previously authorized.

However, in this link, you will find different situations and options to cash the bond of a deceased person: https://treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eedeath.htm.

This happens when people authorize someone else to redeem their savings bonds, who is not necessarily a family member.

In this case, you will need to show:

- Your identification document.

- The legal document that contains the authorization.

- Again, FS Form 1522.

Power of Attorney

You can cash someone else’s bonds if that person authorizes you with a power issued by an attorney; note that you can whether cash one bond or various.

In this specific circumstance, before you go to the financial institution, the attorney must certify his o her signature by presenting the bond to an authorized officer of a bank, credit union, or a trust company.

Otherwise, the power document may be disesteemed since the attorney’s sign has not been certified.

Like the previous cases, you need to provide these documents to the bank representatives:

- Your identification document.

- A power of attorney.

- The FS Form 1522.

➡ LEARN ALSO: I owe the IRS money

Stolen or lost savings bonds

If you lost a bond or if it was stolen, and you are wondering if anyone you do not know can cash it for you, you should not be worried.

As we mentioned during the article, you can be sure that no one can cash your bonds if you did not previously authorize them.

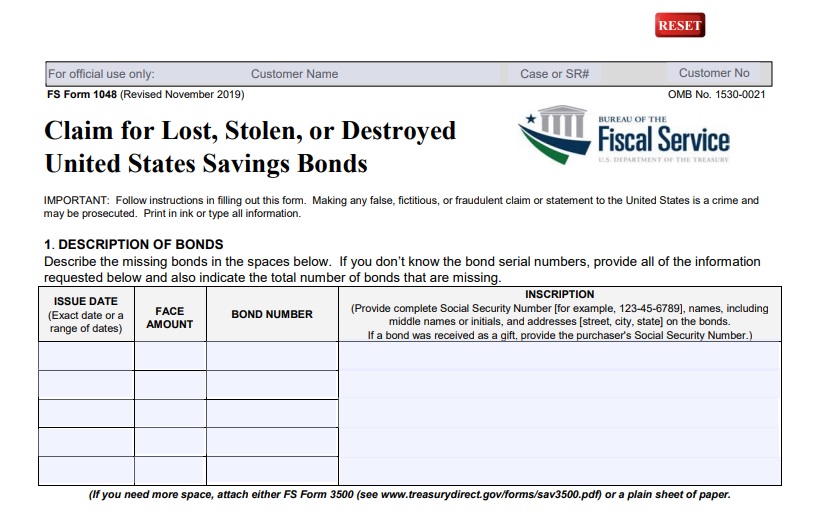

If you need to replace your lost bond, you will have to fill FS Form 1048, and present it to an office of the U.S Department of Treasure; you can download the form in this link: www.treasurydirect.gov/forms/sav1048.pdf.

It is also important to mention that, since January 1st, 2012, bonds are only issued electronically, so you will need to create an account on the official website of the department. Here is the link to do it: www.treasurydirect.gov/RS/UN-AccountCreate.do.